It might seem overwhelming to invest in Lego, because using a children's toy can strike some as unorthodox. Lego can be a diverse and profitable hobby and investment strategy, but it does depend on what approach you take. To get the right balance of time and reward, choose which Lego investor type you'd like to be. You are the person who doesn't have a lot of extra time, but are still intrigued in alternative investing strategies. You don't mind tying up a few thousand (if not more) in non-liquid assets, and you are more investing on the long term. You also don't want to put too much time and thought into your Lego investment. You are probably the Investment Broker Lego Investor. In this case, the ideal strategy is to take a week or two and carefully plan out some sealed sets to acquire, then monitor them every couple of months. Buy some sets that you think will increase in value, then store them for a couple of years (sealed, of course) while they acquire value. Think of managing stocks, except the stocks are Lego sets and they only go up. To get started, I'd suggest heading over to BrickPicker. On their forums you will find invaluable advice about what sets to make your initial investment on, as well as a stock-like ticker for watching the value of your hoard rise. Don't forget to check back here occasionally as well. You probably have plenty of time on your hands, and not much money. You are intuitive, good at recognizing patterns and being diligent. No matter what walk of life this period of extra time occurs in, as long as you have the concentration this is the quickest way to turn a profit with Lego. The goal here is to buy bulk lots of mixed Lego and determine what is valuable, then sell smaller lots to turn a profit. Start by buying Lego lots from yardsales or similar venues (check our page here for online sources). Keep your eye out for minifigures and completed sets, both of which will help you resell. Check out our guide for selling bulk lots which will guide you through the process. Don't spend more than $100 on your first investment--this is a process that requires knowledge of sets and a knack for figuring out what is valuable, so the first run through might not produce the most value. Eventually, you can move to a consignment model, where you agree to sell others' Lego for splitting the profit. This enables you to sell with no initial investment, although you should be sure of your selling abilities. You don't mind risk, and you have some money available to start a new hobby. This approach is more of a hobby that produces money rather than a real investment strategy. You'll be dealing mostly with minifigures, the more collectible, the better. While minifigs appreciate, its not really enough to justify letting them sit around for a long time. Instead, try arbitrage and exploit the price differences on different sites. Selling from Bricklink onto Ebay or Amazon is a classic way to exploit price differentials. Prices vary by week at times, and so selling a figure when it is in demand is key. Another option is to break sets and sell the figures and the pieces separately. Buy a set (a good example is a battlepack or set with rare figures) and then break the set into pieces and figures. Wait until the set retires, and the figures will be worth the initial investment of the set. To profit further, sell the parted out set on a Bricklink store.

0 Comments

I'm excited about the most recent investing opportunity. All signs seem to be pointing towards the retirement of set 10227 Star Wars B-Wing. Released in 2012, this would be on the shorter end of the life expectancy for sets, but Lego.com is already out of stock and Amazon is limiting purchases to 2 per customer. What makes this so exciting is that this is a Ultimate Collector Series (UCS) set, which increases its after market profitability. Regardless, Amazon is currently having a sale that is $50 off of the original price (listed at $200). Even if the set still kicks around for another few months, it seems foolish not to pick up a copy at almost a 25% discount. Good luck investing! Lego may be a children's toy, but it also can be a viable investment strategy (as long as you don't mind storing them in your house!) Following are 4 tips to make the most of a Lego investment.

1) Be Patient Very rarely with Lego can you buy a set one day and then ship it out the next. The most profit comes from making a smart purchase, and then sitting on it for some time until prices rise. After buying a set, do not be tempted to sell it even a couple months after purchase. Most times, prices dip before they rise again. But unlike other commodities, prices of lego always rise back again. The main reason for this is the rarer the set, the more the demand. Since the supply is limited (Lego has stopped manufacturing the set), prices rise in accordance. So don't be discouraged after buying to see the prices slowly deflate. Patience is key. Waiting out the slow decline in price will bring a period later on where prices slowly rise again. How long should you wait? Its really a matter of personal preference, but generally a year after the set is retired (not sold in stores anymore) is ideal. After that point, there is less buzz about the sets, so the prices level out. 2) Know the Market Certain genres and sets do better than others, that much is clear. But how to chose sets and minifigs that will rise the most and give the best returns? To get started, bricklink's past price guide is an invaluable source. Take Medieval Market Village, for example. (Check our investment guide for it here). You might look at the set and think that it could be a good investment. In order to back up your hunch, check out bricklink's price guide. Here, the site is divided up into two columns, one for the past 6 month sales and the current items for sale. In this particular example, the average price for the set in the past six months was $104. Now, however, the average price for current items on sale is $175. Prices are on the rise, time to invest. Over time, hunches fueled by price guide information will show several genres of sets more likely to succeed than others. Generally, modular houses sell the best and have the highest gains. Look at Market Street, almost $2,000 now. Imagine you bought the set when it was selling for $90. You would have invested in a set that grew 10-fold. 3) Know the Minifigs Sometimes, minifigs sell better than the sets that they came in. Selling minifigs is often easier than a set. While with a set the buyer requires a lot of capital (especially if you are selling at the end of the price curve, when prices are the highest), minifigs can be bought by a much wider audiance. Kids often want a full collection of lego star wars jedi knights, which opens up a much larger market. The key then to properly investing in Lego is to diversify the portfolio between minifigs and sets. Star Wars figures typically sell the best. Look at Star Wars clones, which I have been successful investing in. If you bought a bunch of these clones a year or two ago, selling them slowily at today's prices would result in a nice profit. Once again, use the price guide to prospect minifigs that you think will sell well in the future. Unlike sets, minifigs do not always rise in price later, so proceed with caution. If there is low demand for a figure at the beginning, the demand is unlikely to rise later. 4) Don't be discouraged (and how to cash in on the investment) This is really just saying "Be Patient" once again, except in a the arena of selling. Once the time comes to sell your investment, list the wares, but then expect to wait a while. Rare and antique lego has a rabid market, but it does take a while for collectors to both notice the listing and then rally enough cash to buy it. There are several different marketplaces to sell Lego, each with their pros and cons (which I will go more in depth in a following blog post). Just know ebay will net the lowest amount but sell the fastest, Amazon will make you the most money but take the longest to sell and Bricklink will be vary. Still, don't despair when your sets do not sell right away. Just remember that you have a commodity that only a few people in the world have. Buyers will come. Those are the 4 major broad tips to investing in Lego. Let me know though--do you invest? Are you looking to invest? Comment below to let me know! Its been a couple months since I splurged on the Ebay lots, and I will admit it takes a while to become profitable. I still have several figures who have not sold yet, although all of the lots that I bought on Ebay have netted me at least some profit. It is a little hard to gauge--the money from Amazon goes straight to the company bank account while the money spent to fund Ebay investments comes from Paypal. For this method of investment to work, I would recommend a strong Excel spreadsheet that shows money spent, including shipping and all costs. The other thing I would recommend is bulk. I made the mistake of only buying a few lots. The problem is that sometimes you can only go positive by a few dollars or event cents, and having a few lots makes the effort not really worth it.

I recently did something that I do not normally do. I bought lots off ebay. Now I know this is mostly a losing endeavor. Most of the people on ebay know what they are doing, and they are also selling at a profit to themselves. But there still are the amateur sellers out there -- especially in the lego market. With careful looking, I found several lots that seemed characteristic of someone unacquainted with lego. Look for mislabeled figures, bulk lots with plenty of mismatched parts, etc. Sometimes in the listing they will even admit that they don't know anything about lego. I mostly look for stock figures like clones and jedi, because castle figures aren't always going to be recognizable. Once I found a couple of likely lots, I set them up on proxy bidding so I could just schedule the price I wanted to pay and forget about it. (There are many good ones that you can find with an internet search, but I use www.gixen.com). The proxy bidding is nice because you don't have to put extra time into bidding for the lots. I lost some auctions because other AFOLS found the lots, but I ended up with a couple that were filled with a variety of Star Wars figures for a decent price. Now I have to issue a warning here. With all the figures I bought, only now are some of the lots becoming profitable. I bought the lots about 2 months ago, and they are selling rather slowly. But that is okay, because I list on amazon which has a huge markup price. Its especially good for some of you that want to get into the business but have no inventory. Buy some lots, list them and forget about them and eventually they will turn a profit. Worst comes to worst, you can always flip them back on ebay for about the same as what you paid.

Over my time buying and selling Lego, what has come and gone the most has been the minifigs. Sets may bring in the most money, and work nicely in a profit margin, but the minifigs are my bread and butter. And of these, Star Wars figures are the most popular. There is a cycle with these figures. When a new set comes out with new figures, the price of them - regardless if they are Jedi, clones or whatever - the price sparks as people want to collect the fig but not always the set that it came in. This is a nice bubble to sell in, but it quickly dissipates as the set is out for a month, a year. Then, the set becomes retired and the price slowly rises again. The key is to sell minifigs either at the first bubble stage, or hold figures until they become valuable. The best time to invest is about a year into set release, when the market is saturated and the price is low. For example, the Clone Battle Packs were very cheap around a year after they were released (2006). From there, holding around 100 figs proved very profitable. Its not worth it to buy just ten or twenty figures. The difference between selling minifigures and sets is quantity. Being the only seller with a quantity of over 100 is a good reason to charge more than everyone else.

Hope this helps. This is defiantly THE new set for March 2010. It is highly awaited, and has a huge new factor. Myself included, there are many collectors out there who follow these buildings by Lego and are willing to pay to get their hands on them. I

What is it: It is a 3 floor modular building built in the cafe corner style. It has many more minifigs than most other modular buildings, as well as a somewhat furnished interior akin to the Green Grocer. It also has many rare elements such as hairbrushes and perfume bottles that make good scrap selling. Estimated resale price 1 year after retirement: $500 Why is this so good?: This is yet another installment in the modular houses line. As I've mentioned, it has many followers and the sheer detail attracts many other buyers. Other houses in the line also have shown huge increases in price even a month after retirement. Take the market street for example. It is already selling for $500 even though it is only a year out of retirement. That was an $80 set. And like any other Lego exclusive, prices are on the rise on sites like amazon and can not be purchased in other places leading to more demand. Where to Buy: As usual, Lego.com is your best bet, given a steady price. Ebay is an option for this set, but prices are generally too high. Bricklink is selling at $185 right now which might be nice for the convenience, but you'll pay more. I've been eying this set for a while now for Lego resale.

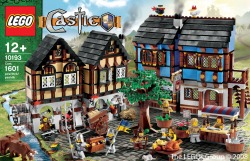

What is it: Its almost in the line of modular houses in its construction patterns, and it profits from having 8 castle minifigs. It was released 2009, so it is going to get retired sometime soon. Estimated resale price 1 year after retirement: $300 So why is this so good? Already, prices have started to increase even though the set is not yet retired. Check Amazon for example. Even though you can buy it on Lego.com for $100, the price has already spiked to $150. It is a lego exclusive, limiting acquisition possibilities, but meaning that it is becoming more rare. Even on Bricklink where you can find most sets for less then they sell for has the set up about $10 on base price. This is even before the set has retired. This is a Lego set that definitely will be a good investment. The best part is, even if the whole thing falls through, you can always sell it for scrap. Its got tons of rare pieces in there, from the cows to the hairbrushes. It is defiantly less fun to nickel and dime yourself to profit, but with this set it is defiantly possible. Where to buy: Unfortunately, since the other sites are already turning a profit and its a Lego exclusive, the only possible meathod is to buy from Lego.com or the store. You could get lucky at Ebay, but again sets there are selling for about $150 already. Here at Snazz Industries, our whole business is about finding sets that are profitable and will increase in value over time. This blog will cover our findings in the resale Lego market. We will cover sets that are new, as well as deals on old sets that could prove valuable in the future. This is a guide for sellers of Lego or even just interested buyers. This blog will be updated at least once a month with a new set, so check back often or subscribe to our RSS feed.

|

PurposeTips and Tricks for Selling Lego online, including sets and minifigs to save for later. Lego Investment advice. Archives

December 2013

Categories

All

|

RSS Feed

RSS Feed